Award-winning PDF software

Form 7004 for Georgia: What You Should Know

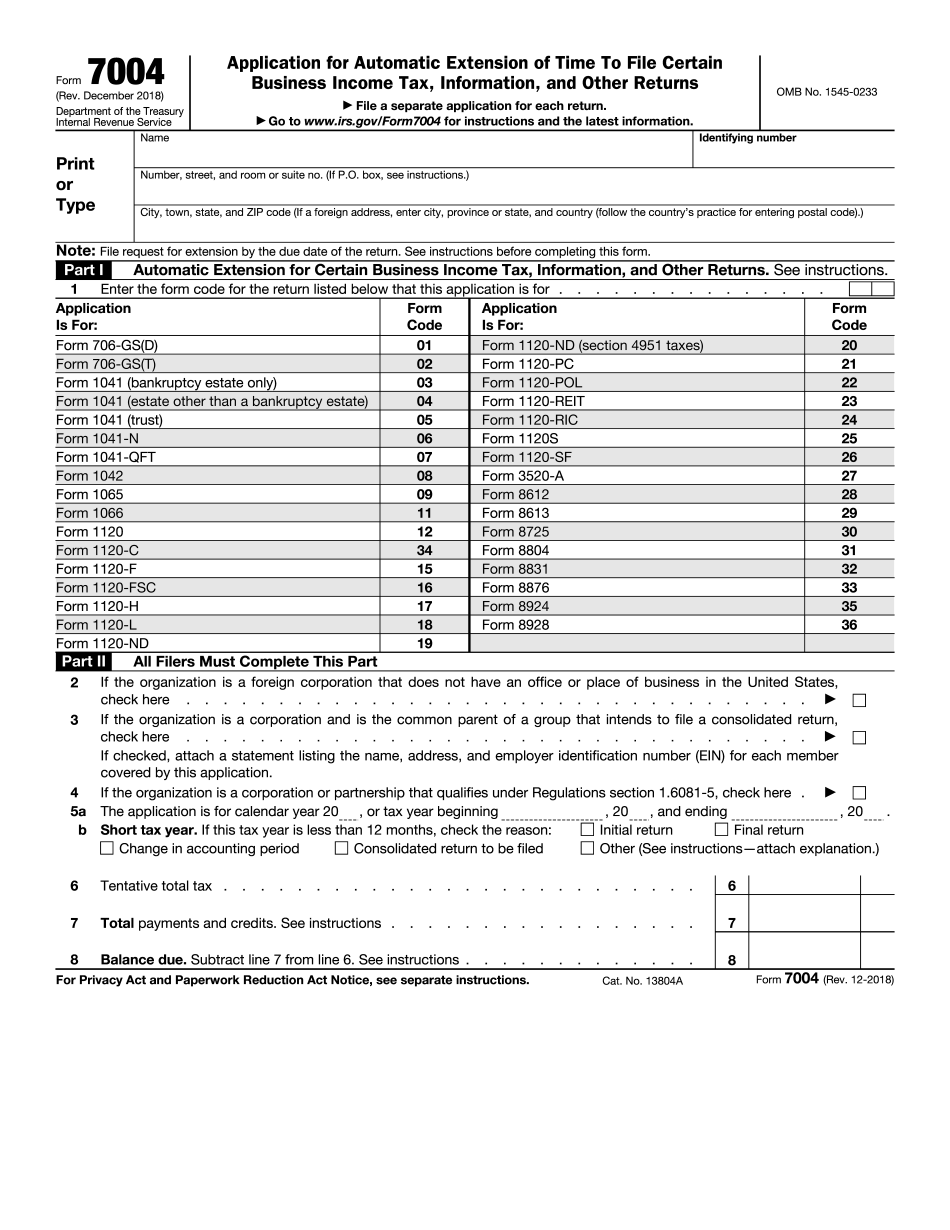

Federal tax extension is available online for qualified taxpayers with income above certain thresholds. Qualifying taxpayers can apply online for an automatic extension of time. Georgia Taxpayer Bill of Rights. State business income tax rules are different from federal tax rules. Therefore, it is important to review the Georgia Business Income Tax Law. Extension of time for filers to lodge a return. Form 1-470 can be used in lieu of Form 7004 to request an extension. Download Form 1-470. There is no additional fee for this form. You can use Form 7004 for the same purpose; however, the State will not accept it. About Forms 7004 and 70-22 | Georgia Business Expenses & Taxes Georgia business tax law and procedures are complicated. Taxes for Georgia Businesses and Tax-Exempt Organizations Georgia has a 3.07% 3.88% corporate income tax, a 2%, state income tax, an independent local value added tax (VAT), an individual income tax, and a real property rental tax. The individual income tax is levied on wages, and is administered and administered on the county level. The real property rental tax is levied by a private collection agency. The real property rental tax has been implemented in Georgia. Taxes for Georgia Expats (Foreign) Businesses A tax equal to 9.15%, effective January 1, 2018, must be paid on all non-profit Georgia-resident, foreign business entities. The following state and county tax rates apply to taxpayers with taxable gross receipts beyond 500.00: State County Business Tax Rate 3.13% 2.63% 8.00% 5.00% 7.50% 15.00% 24.00% 35.00% 46.00% 55.00% 100.00% State Taxation of Georgia-resident Non-Profit Tax Exempt Entities (Fees) Fees include the State Fair Trade Commission, Georgia State University, Community Schools of Northern Georgia, Georgia Southern University, Georgia Agricultural Center, and various other organizations. Fees receive tax exemption on their taxable gross receipts to the extent the FBE has a regular place of business in Georgia. Business tax exemptions are available to Fees on their gross receipts at a rate of.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 7004 for Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form 7004 for Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 7004 for Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 7004 for Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.