Award-winning PDF software

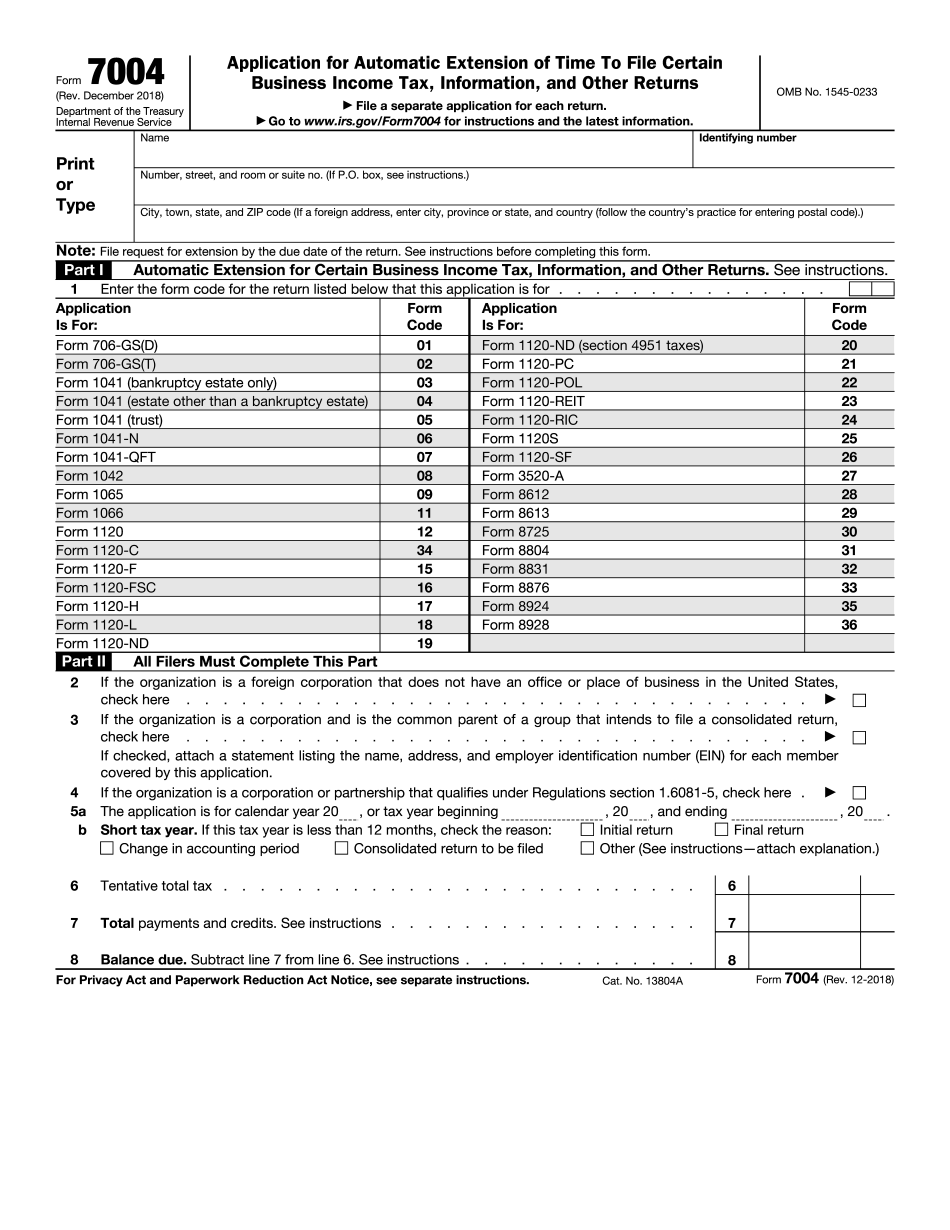

Form 7004 California Alameda: What You Should Know

Form 8832, Entity Classification Election… rather file as a corporation, Form 8832, Entity Classification Election, must be submitted. Filing a New Pennsylvania Limited Liability Company (LLC) Business The first step in creating the LLC as a New Pennsylvania Limited Liability Company (LLC) is to register as a corporation. Register a Pennsylvania Limited Liability Company (LLC) — Form PLC LLC (A.4. C) You can register a new LLC or amend an existing New Pennsylvania LLC in Pennsylvania. A.4. C — Application for Limited Liability Company Registration, 2015 As a general rule, an LLC may not be formed and existing LCS may not be amended in the same State. However, under Pennsylvania Business Corporation Law (PBC Law), LCS may be formed and existing LCS may be amended in the same State where the limited liability company is organized. The PBC Law requires certain requirements to be met before the corporation's governing documents can be created. The General Corporation Law (GPL) of the State of Pennsylvania (PCL) regulates all corporations established by a natural person. It does not regulate corporations composed of an organization or an association. The GPL does not have provisions dealing with: • Business corporations (such as sole proprietorship or partnerships); • Sole shareholder corporations (such as limited liability companies). Sole shareholder corporations do not, however, impose the requirements imposed on corporate limited liability companies when formed as defined in this article that require the corporation to be organized as a business corporation, that it be taxed as a business corporation or that it be required to be organized and maintained by a governing body that is recognized as a business corporation by the Pennsylvania Corporation Law. • New limited liability companies (such as limited liability partnerships); or • Any other type of corporation. The following types of corporations may be formed in Pennsylvania: • Limited liability companies organized in Pennsylvania (such as limited liability partnerships) • Special purpose limited liability companies (such as tax-exempt organizations) • Corporation formed for the purpose of doing business, as defined in Section 80.6 of P.L.1983, c.162. All persons who are to be members of or otherwise serve on any such company or any of its parts may be required to be members of the general partner, as a partner in the case of business corporations, or member in the case of limited liability companies.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 7004 California Alameda, keep away from glitches and furnish it inside a timely method:

How to complete a Form 7004 California Alameda?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 7004 California Alameda aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 7004 California Alameda from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.