Award-winning PDF software

Salinas California Form 7004: What You Should Know

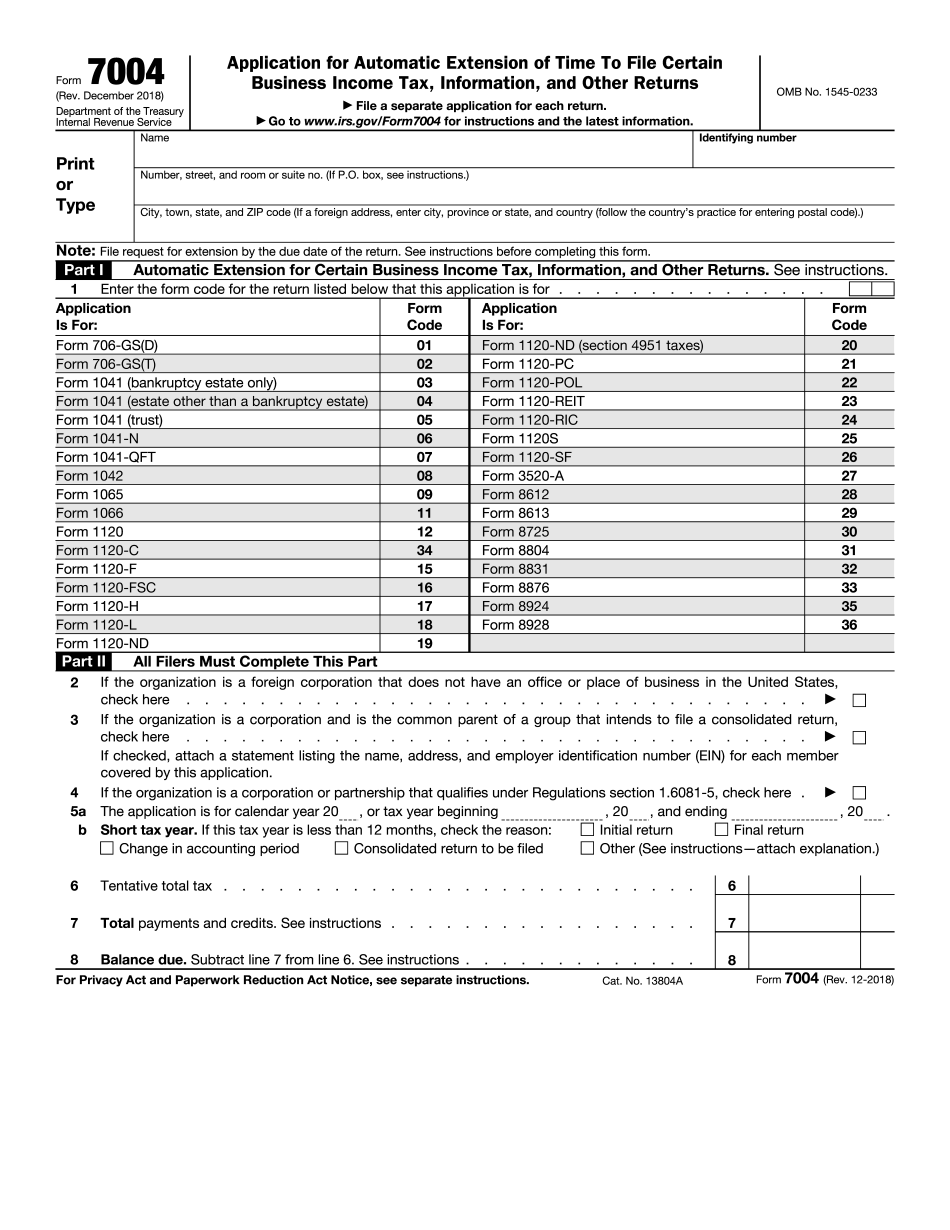

Extension of Time to File a Tax Return — California | TaxTipsForBusinesses.org The extension of time to file is good for tax purposes only on the date that the extension is received by the tax collector, and for no more than 60 days after that, unless otherwise extended, and is not good for any period after the return becomes final. Tax Tip for small employers -Salinas — Favorite & Darling, Inc. If you have a small business, go through Form 9006, Small Business Employment Tax, and send it to your local IRS office. This is to allow the IRS to track the workers you hire. The amount on the form is not taken out until every worker is paid and properly reports. The form has a big “T” on the top and tells the tax collector all to which it applies. If you don't send it in, the IRS doesn't know who gets their pay and who doesn't. Tax Tip For Individuals -Salinas — Favorite & Darling, Inc. If you find yourself in this situation, you should contact a local tax attorney and the IRS to schedule a hearing to contest the return. This will provide you with an opportunity to resolve the situation and have the correct information sent to you. Tax Tip: The IRS does not provide tax-free accounting services. For the complete list of businesses/organizations, visit the IRS Forms and Publications page. Extension of Time to File a Tax Return (Form 7004) | Internal Revenue Service You may be eligible for one or both of The following: A) One or more extensions of time to file for the first time for any tax year to which the taxpayer is a resident; and B) One or more extensions of time to file for one or more nonresident tax years (as described in the instructions to Form 7004). How to get a Form 7004 Extension To file a tax return. You must have filed some and, if you filed an amended return, you must have filed an amended return on a timely basis. In order to receive an extension to file your return, your income tax return must be current and all other information on there must still be correct. See Publication 1461 to see if you are a resident for the tax year to which you are requesting an extension. You must obtain a Form 7004 (with an extension of time to file statement if applicable) at the address above or directly from the IRS by mail or in person.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Salinas California Form 7004, keep away from glitches and furnish it inside a timely method:

How to complete a Salinas California Form 7004?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Salinas California Form 7004 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Salinas California Form 7004 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.