Award-winning PDF software

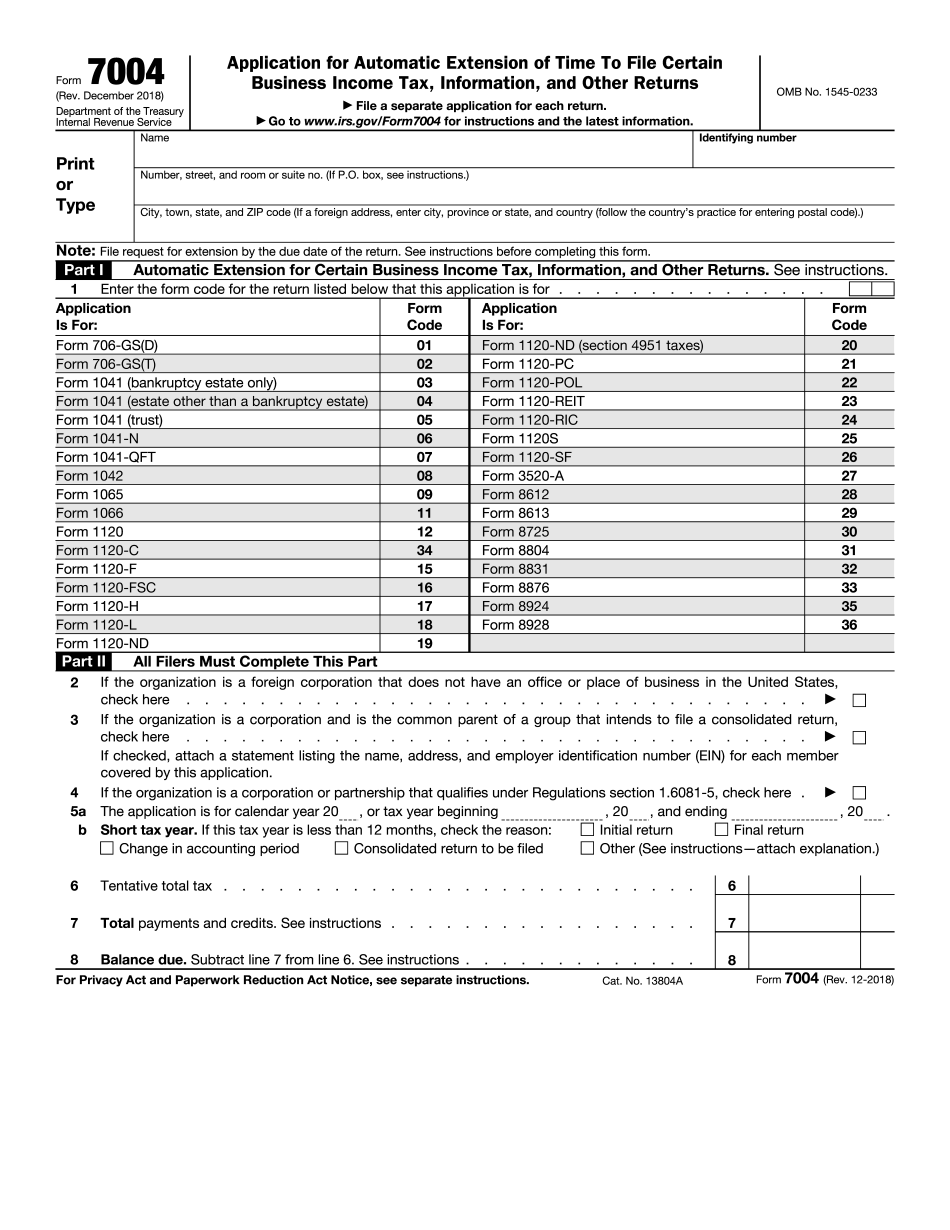

Overland Park Kansas Form 7004: What You Should Know

Form 7004 — Application For Automatic Extension of Time to File Corporations Income and Franchise Tax Return File Form 7004 for an automatic six-month business tax extension (if paid on or before June 30) if you completed Schedule TO (Form 7004) before January 1, 2022. Form 7004 (PDF format) Form 7004 Application (PDF format) The information on this website was provided to Business Tax Services, Inc. at no charge. The Company reserves the right to add or change any information provided on this web page at any time. Do you have questions about Form 7002? Email us at TaxKansasCity.org In Kansas, a corporation does not file Form 7002. A corporation must file the Form 6191. Please visit the Kansas Corporations web page for more information. You can also contact the Kansas Department of Revenue at for additional information. Kansas is currently experiencing a massive influx of corporate franchise tax returns. This has created a tremendous amount of confusion. It is the purpose of this guidance to make sure both the K-1 and Form 7002 filing deadlines are met in the most appropriate way, so businesses have the most reliable information possible regarding their tax returns. We would really appreciate your understanding if our tax information does not answer your questions. I don't have the answer. Is it something I should check with the IRS? Yes. They will want to see the documentation provided with this tax form. Check with our office, and you'll get the details. Where can I go to find the Form 6191? Visit the Kansas Corporation Returns web page for more information. Frequently Asked Questions When do I have to file a Kansas Form 706 if I'm filing my 707 and K-1? We do not have to file a Kansas Form 706 unless you have paid tax before, as we are not filing a second return for you. If you have paid the tax before, it won't matter. Is there a different process if an individual taxpayer files his/her individual federal Form 706 then their Kansas 706? What if I don't file a federal Form 706? The only way an individual taxpayer can avoid filing a Kansas K-1 is by not paying income taxes with their employer before July 1, 2017. The K-1 will then be filed and must first be filed with the IRS before a Kansas Form 706 can be filed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Overland Park Kansas Form 7004, keep away from glitches and furnish it inside a timely method:

How to complete a Overland Park Kansas Form 7004?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Overland Park Kansas Form 7004 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Overland Park Kansas Form 7004 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.