Award-winning PDF software

Form 7004 Online Knoxville Tennessee: What You Should Know

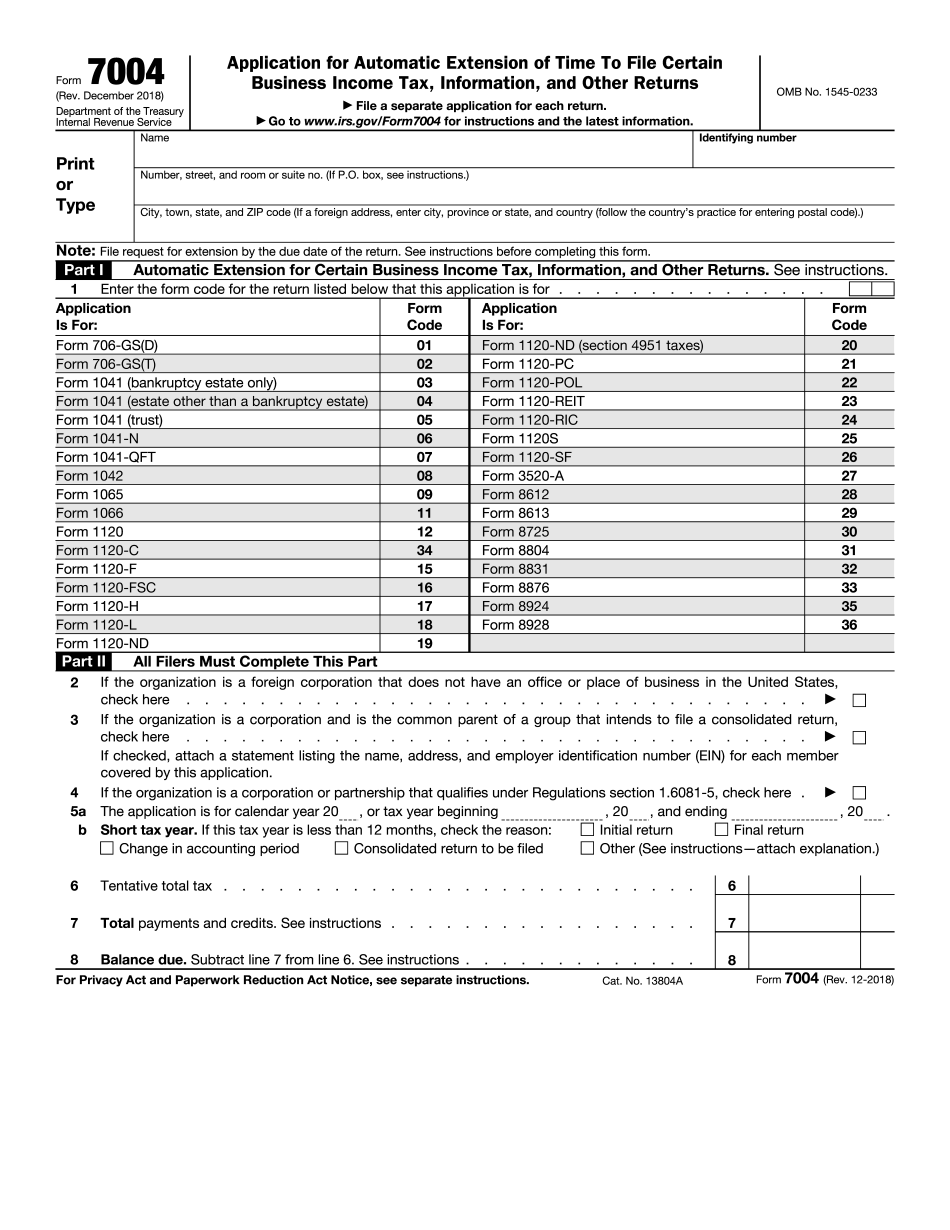

Form 7004 application for extension of time to file certain business income tax returns is issued by the Internal Revenue Service. It is based on an application form which you fill out, complete, and submit electronically for use by the Internal Revenue Service to request an extension of the time period in which to FILE the tax return or ITIN or SSN tax return with the IRS. Please read the information printed on the form carefully. Forms, instructions regarding how to fill them out, and other information relating to Form 7004 are provided by the Internal Revenue Service. If you apply for a tax extension of any kind before you file your federal tax return, the IRS must request payment of the tax extension before you can expect the tax return to appear on your account. That means you must file your federal tax return before you can apply for another extension or for the tax return to be paid. Please allow up to 4 weeks or as long as 6 months for a tax extension from the date of first payment of tax if the extension is for more than 90 days past due, and you have already filed your federal tax return. When You May Not Be Able to File Your Federal Tax Return Some situations may cause you to be not be able to file your federal tax return. If you do not meet the conditions for filing, or need more time to file (e.g. you owe a tax penalty), you should inform the Internal Revenue Service immediately by following the instructions included on the Form 7004. Filing late can be costly and prevent you from providing many necessary information for the tax agency. If you believe you have been denied a request to file, speak to your agent and find out why. You may then file Form 7004, which will give you a period of time to file if you are unable to file a federal tax return. The IRS can ask you to provide more documents even if you believe you have answered the question and completed the form correctly. For example, a Form 7004 might ask you to provide more information if you need to include a document that was not included in your form. The IRS also can ask you to produce more documents if you need to correct something in your returns, such as a failure to state a business tax credit to support a claim for a non-business personal or dependency exemption.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 7004 Online Knoxville Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 7004 Online Knoxville Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 7004 Online Knoxville Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 7004 Online Knoxville Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.