Award-winning PDF software

Chula Vista California online Form 7004: What You Should Know

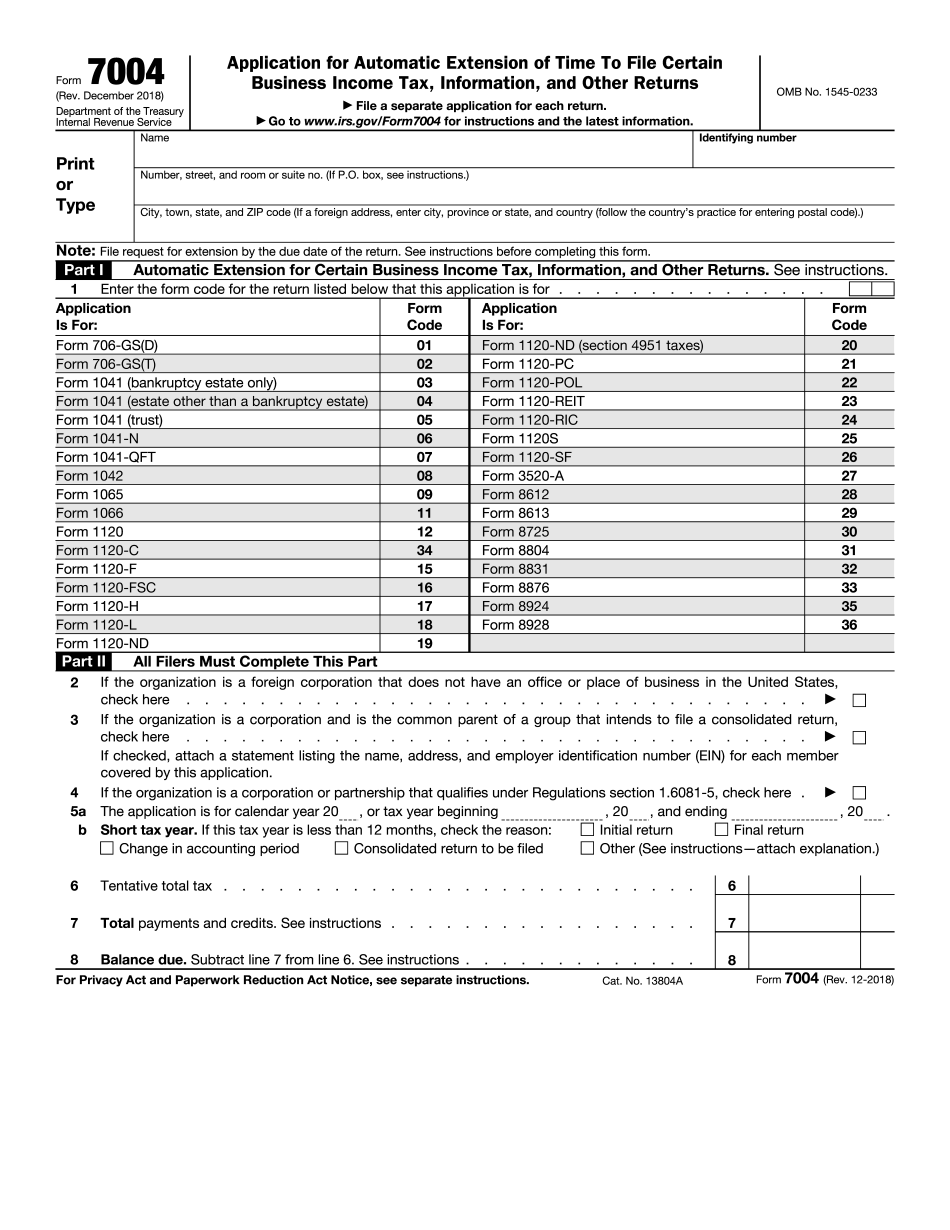

Application for Extension of Time to File Business Return (FIFA) (Form 8442) A filing extension allows you to file your return without having to visit your local county clerk's office to verify your status. A business tax return is usually submitted every four (4) years, and it is estimated that the average effective tax rate is 0.25%. However, if you wish to file a Business Tax Return the late filing fee of 195 will be assessed. Your filing deadline is six (6) months after the business filing deadline. The fee will be waived if a payment plan acceptable to the county is entered into in writing, or if a payment of tax, interest or penalty not required by law (i.e., a tax on certain capital gains not imposed by the state) is paid within the extension period. What is Required to File as a Personal Business? Filing Fee (Form 8812). If required, a Business Exempt Use Tax (BET) Payment Plan is required Filing Date; Monthly Filings; Form 2848, Balance Sheet, and Monthly Filings for an Existing Business (Form 3858). In order to determine if you are a personal business you must file an annual report by the due dates. Form 4868 (Financial Statements). You must file an annual report each April to June. If a business is created or acquired by an individual who also is the owner of the business but does not maintain a legal, physical, or managerial relationship with the business, a filing agreement, Form 1120-G, must be completed. Filing Deadline; Extension of Time for filing Return; Amounts due (FIFA) You must file your return by the due date provided on the return (for example, April 30 if Form 2555, Payment by Federal Employer; Filer's Report, is filed) if: · The return is not received by the due date, or is less than three(3) months postmarked, OR · The due date is more than nine(9) months postmarked, OR · A notice is mailed to the taxpayer's address informing taxpayers of the due date. · The tax due date is more than eighteen(18) months after the due return was filed. · The tax period for which tax is not to be paid to the Tax Collector on the due date is more than twelve(12) months from the due return(s).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chula Vista California online Form 7004, keep away from glitches and furnish it inside a timely method:

How to complete a Chula Vista California online Form 7004?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chula Vista California online Form 7004 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chula Vista California online Form 7004 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.