P>Hello guys, how are you doing? Welcome to Falling Dub. If this is your first time here, please be aware that there is a red button here. If you want to subscribe, you need to click to that link. Today, I'm going to show you how to fill out the form 89-62. It is an update for 2018. I have a previous video, but this one sees days of change. But, really, some few changes have happened. So, like the last video, we're going to do step by step. You're going to follow me so let's talk about what you need before going to the phone. You will need the code copied 1095 from the marketplace. Ladies, copy this code if you have not already. Then, you need your task. You'll need to get some information from your tax return. This is the letter that you will see that says “N.” You will need to get the first page at the back of this letter. The page I would encourage you to cut out and read each other back. The first page of this letter is important. Basically, you need three paper. Let's say, for example, that you are filing your taxes for 2018. You would need the 1095A, the cover sheet, and the control number. The control number is really important because it has your case number, your social security number, and each tax year. I will encourage you to put all of this information on this cover sheet and look like a cover sheet. We're going to do this step by step. It's easy guys. By the way, if you want to encourage me, there is a link below for you to use. If you want to encourage me, just hit the PayPal button. I've been doing this for a while,...

Award-winning PDF software

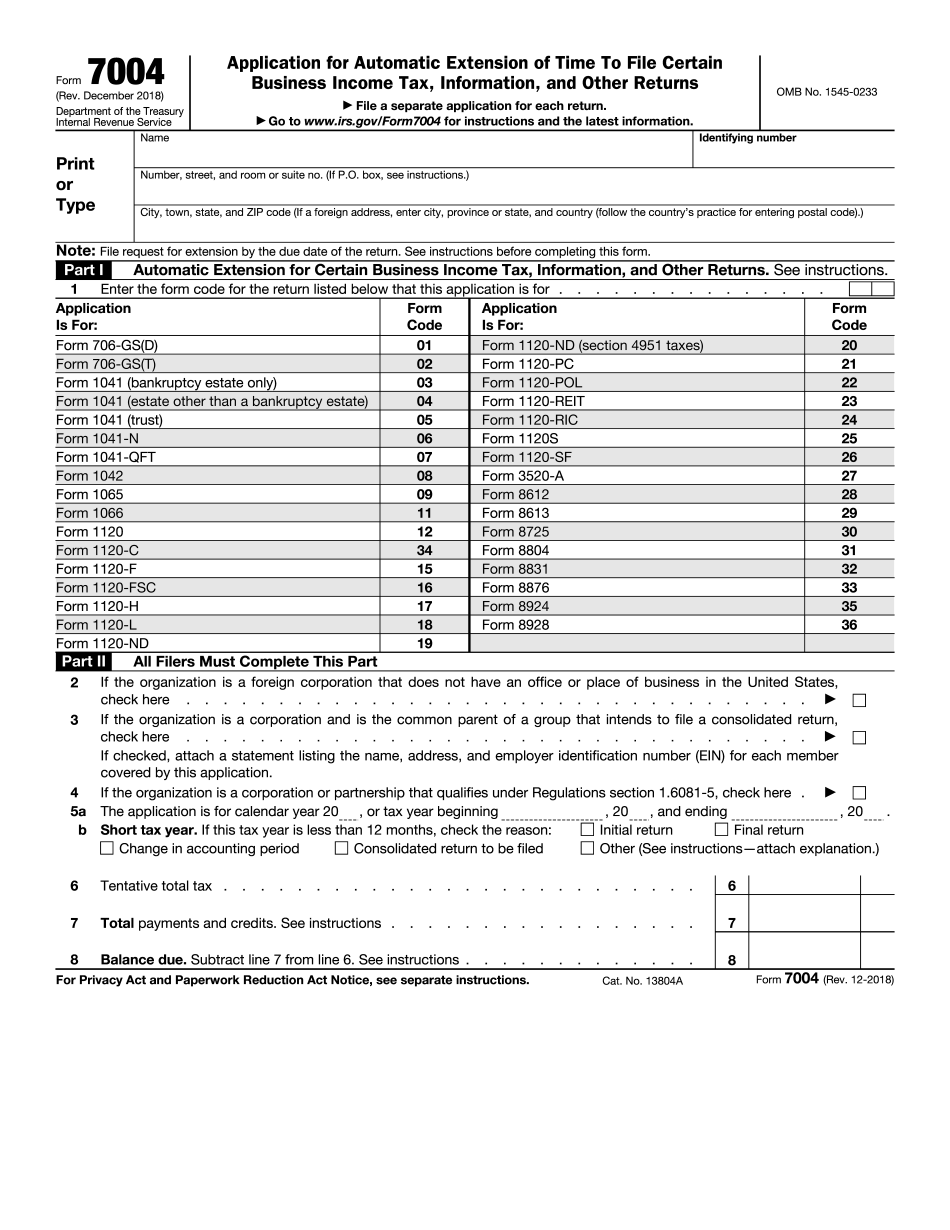

How to prepare Form 7004

About Form 7004

Form 7004 is an application for an automatic extension of time to file certain business income tax, information, and other returns. It's used to request an automatic extension of time to file a variety of tax forms, including Forms 1065, 1120, 1120-S, 1041, and 8804. Any business or organization that needs additional time to file their tax return can use Form 7004, including partnerships, corporations, estates, and trusts. Filing this form allows businesses to extend their filing deadline by up to six months. However, it does not extend the deadline for payment of any taxes owed.

What Is Form 7004 Extension 2019?

Online technologies allow you to arrange your document administration and strengthen the productivity of the workflow. Observe the brief information in an effort to fill out Irs Form 7004 Extension 2019, prevent mistakes and furnish it in a timely manner:

How to fill out a Form 7004?

-

On the website containing the document, click Start Now and pass to the editor.

-

Use the clues to fill out the suitable fields.

-

Include your individual details and contact information.

-

Make certain that you enter suitable details and numbers in proper fields.

-

Carefully examine the written content of your form so as grammar and spelling.

-

Refer to Help section when you have any concerns or contact our Support staff.

-

Put an digital signature on the Form 7004 Extension 2025 Printable using the help of Sign Tool.

-

Once document is finished, click Done.

-

Distribute the ready form by way of electronic mail or fax, print it out or download on your device.

PDF editor lets you to make alterations to the Form 7004 Extension 2025 Fill Online from any internet connected device, customize it in accordance with your requirements, sign it electronically and distribute in different means.

What people say about us

Reasons to use electronic digital forms vs. paper documents

Video instructions and help with filling out and completing Form 7004